Denied Tornado Damage Claims Attorney

Tornadoes are a destructive natural phenomenon that can strike quickly and without warning. Over 1,200 tornadoes occur in the U.S. every year, causing hundreds of millions of dollars in home and property damage. Recovering from a tornado can be overwhelming, especially when your insurance company denies your claim. If you find yourself in this situation, do not hesitate to contact a reputable tornado damage lawyer. We understand the challenges that come with recovering from a tornado and will help fight for the compensation you need to rebuild your life.

How Common Are Tornadoes?

Wisconsin experiences around 23 tornadoes a year. These natural disasters pose severe health hazards, not just from the immediate impact but also from the destruction they leave. For instance, the summer of 2014 witnessed southwestern Wisconsin grappling with extensive damage due to tornadoes, high winds, and hail, which led to injuries and the demolition of several buildings. The National Weather Service usually issues between one and two tornado warnings and five to 10 severe thunderstorm warnings per county annually in Wisconsin’s southern regions, with fewer warnings in the northern areas.

Types of Insurance Claims

We can help with multiple types of insurance disputes.

Property Insurance Dispute Lawyer

Commercial Property Insurance Dispute Lawyer

Wisconsin Insurance Dispute Lawyer

Does Insurance Cover Tornado Damage?

In most cases, tornado damage is covered under both homeowner’s and renter’s insurance policies as part of windstorm damage provisions. For homeowners, this includes structural damage to the house itself, as well as any detached structures, such as garages or sheds, depending on the specific terms of the policy. Renters insurance, while not covering the building’s structure, protects the tenant’s belongings within the rented space against tornado damage.

Both policy types typically come in two forms: actual cash value (ACV), which reimburses the policyholder for the property’s depreciated value at the time of the damage, and replacement cost value (RCV), which covers the expense of replacing the damaged items with new ones of similar type and quality without depreciation deduction.

In addition to covering structural damage, homeowners insurance policies often cover personal property, which includes items within the home. However, the exact terms of policies can differ, and you should always review yours to understand your exact coverage.

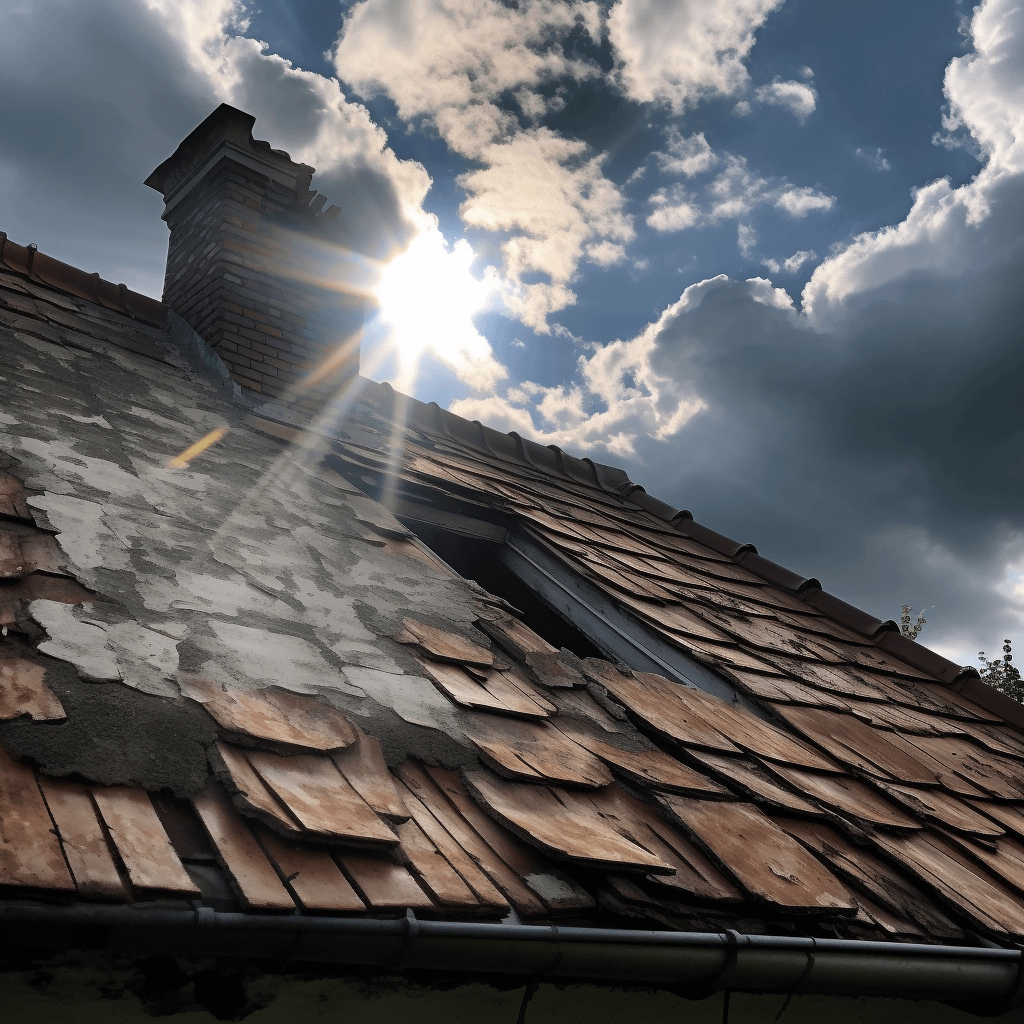

Tornado Damage: Examples and Long-term Consequences

Tornadoes unleash their fury with little warning, leaving a trail of destruction that can vary from minor to catastrophic. The force of a tornado can rip roofs from buildings, uproot trees, and hurl debris like lethal projectiles. The aftermath of such a storm not only results in immediate property damage but also carries long-term consequences for the affected communities. Here are some examples of the havoc that tornadoes can wreak:

- Roofs: A tornado most often affects roofing. There may be missing or broken roofing shingles, dents, chips, or cracks in existing roofing, or entire portions of the roof torn or blown away. Detached gables or chimneys are also common.

- Walls and floors: The interior and exterior of walls may be damaged, especially in cases where windows were left or broken open during the storm. Exterior siding may be damaged and become exposed.

- Structural damage: In severe cases, a storm may leave the frame and foundation of your home or commercial property with structural damage that needs to be remedied for it to become usable again. At other times, there may be subtle issues caused by a tornado, such as roof sealant and fastener wear, that jeopardize the overall structural integrity of your property over time.

- Windows and doors: Broken windows are especially common in the event of tornadoes. Unlike in hurricanes, oftentimes homeowners only have time to shelter themselves and family members, and not a chance to board up and protect vulnerable windows and doors. Flying debris can smash window panes, as well as tear shutters and screens.

- Gutters: Gutters may be torn away entirely in a tornado.

- Electrical damage: One kind of lasting damage that can occur in a tornado is electrical damage. Electrical damage leaves your home at risk of future concerns, such as fire.

- Plumbing damage: Flood water as a result of a tornado can be a risk to your home’s plumbing. Additionally, standing water left after a major storm can lead to contamination of drinking and bathing water, as well as electrocution risk from downed power lines.

- Gas leaks: Gas leaks are a particularly dangerous possible outcome of a severe tornado. Infrastructural damage from a major storm can lead to further problems down the road for your home’s livability and resale value.

Should I File a Tornado Damage Claim?

Yes, in the wake of a tornado, documenting the extent of the damage and promptly filing an insurance claim can help you obtain the necessary funds for repairs and rebuilding. In Wisconsin, the window for filing a tornado damage claim is constrained by a statute of limitations. Policyholders have just one year from the date of the loss to bring a claim, unless their policy states otherwise. This tight time frame underscores the importance of acting quickly after a tornado.

Tips for Filing a Tornado Damage Claim

A good tornado damage policy can help you repair damage, restore value to your property, and ensure that your home stays safe after a dangerous weather event. Some policies even help cover the cost of temporary housing while you are having work or repairs done to your property after the storm.

- Protect your safety: Never walk in standing water after a storm, and look out for downed power lines, trees, or other dangerous areas after a tornado. Remember that there may be structural damage to your home. When in doubt, protect yourself and your safety first.

- Document the damage: As soon as you know it is safe to do so, document the damage done to your home. Take pictures or videos that show the state of the roof, windows, doors, and every area of your home that may have been affected.

- Make a list of supplemental damage: Some policies cover your valuables and other property that may have been damaged or affected by the storm. Others cover your pets, including veterinary and burial expenses for weather-related injuries.

- Get your home professionally inspected: For all that they are extreme weather events, tornadoes can cause additional damage that may be difficult to spot with the naked eye. Some long-lasting damage after a tornado may involve roofing sealant or extreme wear and tear on fasteners. Having your home fully inspected after a storm can save you headaches later on.

- Get in contact with your insurer: File a claim with your insurer either online or over the phone. Keep records of your conversation, and ensure that your documentation of the damage is received.

- Speak to an insurance dispute lawyer if your claim is undervalued or denied: If your tornado damage claim has been denied, you have the right to request an explanation. You also may be able to file an appeal. Do not let an insurance agent take advantage of your inexperience. Get help from the experts at Wallace Law to understand why your tornado damage claim may have been denied, and what you can do about it.

File an internal appeal against a denied claim: An internal appeal is your opportunity to point out any minor errors or discrepancies in your claim processing. It also allows you to re-present your case with corrected and updated information to support your claim.

Why Do Insurers Deny or Delay Tornado Damage Claims

As tornado damage claims have increased in recent years, home insurers may attempt to protect their bottom line by reducing the amount of money paid out to claimants. Some home insurers may attempt to argue that some home damage was caused by flooding, and not by the tornado, even though these two events are often linked. If your contract contains anti-concurrent clauses, the claim may be plausibly denied. If not, you may have a case for an appeal. Some common reasons for claim denial or delay include:

- Failure to maintain adequate coverage: Policyholders might not have sufficient coverage for the types of damages incurred, leading to claim denial.

- Failure to make payments on time: Missed or late payments can result in a lapse in coverage, giving insurers grounds to deny claims.

- Insufficient evidence: Without thorough documentation of the damage, insurers may argue that there is not enough evidence to support the claim.

- Coverage exclusions: Certain types of damage may not be covered under the policy’s terms, leading to denied claims.

- Policy terms misunderstanding: Misinterpretations or lack of awareness of specific policy terms can result in denied claims if the damage falls under exclusions or specific conditions not met by the policyholder.

- Allegations of fraud: If insurers suspect fraudulent activity related to the claim, they may delay processing or deny the claim outright.

Insurers meticulously review claims against policy details and the circumstances of the damage. Policyholders should carefully review their insurance policies and understand what is covered and what is not. In cases where claims are denied or delayed for any of these reasons, seeking legal assistance can provide the necessary guidance and support to challenge the insurer’s decision.

Do I Need a Tornado Damage Insurance Dispute Attorney?

Hiring a tornado damage insurance dispute attorney might seem like a big step, but it could be crucial if you are facing challenges with your claim. Sometimes, insurance companies use unfair, or bad-faith, strategies to delay or deny claims. They might ask for unnecessary paperwork, interpret policy language in the narrowest way possible, or claim that the damage was due to another reason not covered by your policy. It is their way of trying to reduce payouts.

If you are stuck in a situation where your claim is not being handled fairly, or if it feels like you are being given the runaround, an attorney who knows the ins and outs of insurance law can be your best ally. They can push back against these tactics, negotiate with the insurance company, and ensure your claim is taken seriously.

Insurance Dispute Lawyer Near Me

Wallace Law is easily accessible for anyone seeking assistance with insurance claims. Our office is situated at 1414 N Taylor Dr. Suite 200, just off Superior Ave and nearby HSHS St. Nicholas Hospital. Whether you’re navigating the complexities of a denied claim or need advice on insurance disputes, our skilled attorneys are ready to provide the guidance and support you need.

Denied Tornado Damage Claims Attorney: FAQs

1. How Much Damage Does a Tornado Cause?

The extent of damage caused by a tornado can vary greatly, ranging from minor damage, such as broken windows and downed trees, to catastrophic destruction, including the complete demolition of buildings. The financial impact also varies, potentially reaching into the billions for severe events.

2. What Type of Insurance Covers Damage from a Tornado?

Homeowner’s and renter’s insurance policies generally cover tornado damage. This includes structural damage and personal property for homeowners, and personal property for renters. Specific coverage details may vary between policies.

3. Does Wind and Hail Insurance Cover Tornadoes?

Yes, tornado damage is typically covered under the windstorm damage provisions included in most standard homeowners and renters insurance policies.

4. Is Tornado Damage Covered by Homeowner’s Insurance?

Yes, tornado damage is usually covered by homeowners insurance. This coverage generally includes the structure of the home and may also include detached structures, personal property, and additional living expenses, depending on the policy terms.

5. Does Auto Insurance Pay for Tornado Damage?

Auto insurance will usually cover tornado damage to your vehicle if you have optional comprehensive coverage. Comprehensive coverage protects against a variety of non-collision incidents, including weather-related damage like that caused by tornadoes.

6. What Are the Cons of Filing a Homeowner’s Insurance Claim for a Tornado?

Filing a homeowners insurance claim for tornado damage can potentially lead to an increase in premiums, as insurance is a “package policy” that spreads risk among all policyholders. However, it is important to remember that the benefits of filing a claim—such as receiving compensation for damages and repairs—far outweigh these potential downsides. Filing a claim can provide the financial support needed to recover and rebuild.

7. How Long Do You Have to File a Tornado Insurance Claim in Wisconsin?

In Wisconsin, the statute of limitations for filing a tornado insurance claim is generally one year from the date of the damage. Act swiftly to ensure your ability to recover losses.

8. Why Do Insurance Companies Delay Settlements?

Insurance companies might delay settlements to conduct a thorough review and investigation of the claim. This process can involve verifying the extent of the damage, ensuring the claim complies with the terms of the policy, and sometimes, unfortunately, employing tactics to minimize payout amounts. Delays can also occur if the insurance company is handling a high volume of claims, especially after a major disaster.

9. How Many Home Insurance Claims Can You File?

Technically, you may file an unlimited number of home insurance claims. It is important to note, however, that filing too many claims over a short time frame can flag you as a high-risk policyholder, and it may lead to increased premiums or even non-renewal of your policy.

10. What Should I Not Say to a Home Insurance Adjuster?

Avoid speculating about the cause of damage or admitting fault. Do not underestimate the value of your loss or agree to a settlement before fully understanding the extent of the damage. Always communicate through documented means and consult with a tornado damage attorney if unsure.

Contact a Tornado Damage Lawyer for Help

With the help of an experienced tornado damage lawyer, you can make the strongest possible case to your insurer about every area of coverage that you need. If your appeal is denied, you may even be able to take your case to court.

A tornado can be a dangerous and traumatic event to live through. Fighting with the insurance company is the last thing you need after going through such an extreme circumstance. If you need help, contact Wallace Law today and find out how we can build a case on your behalf.