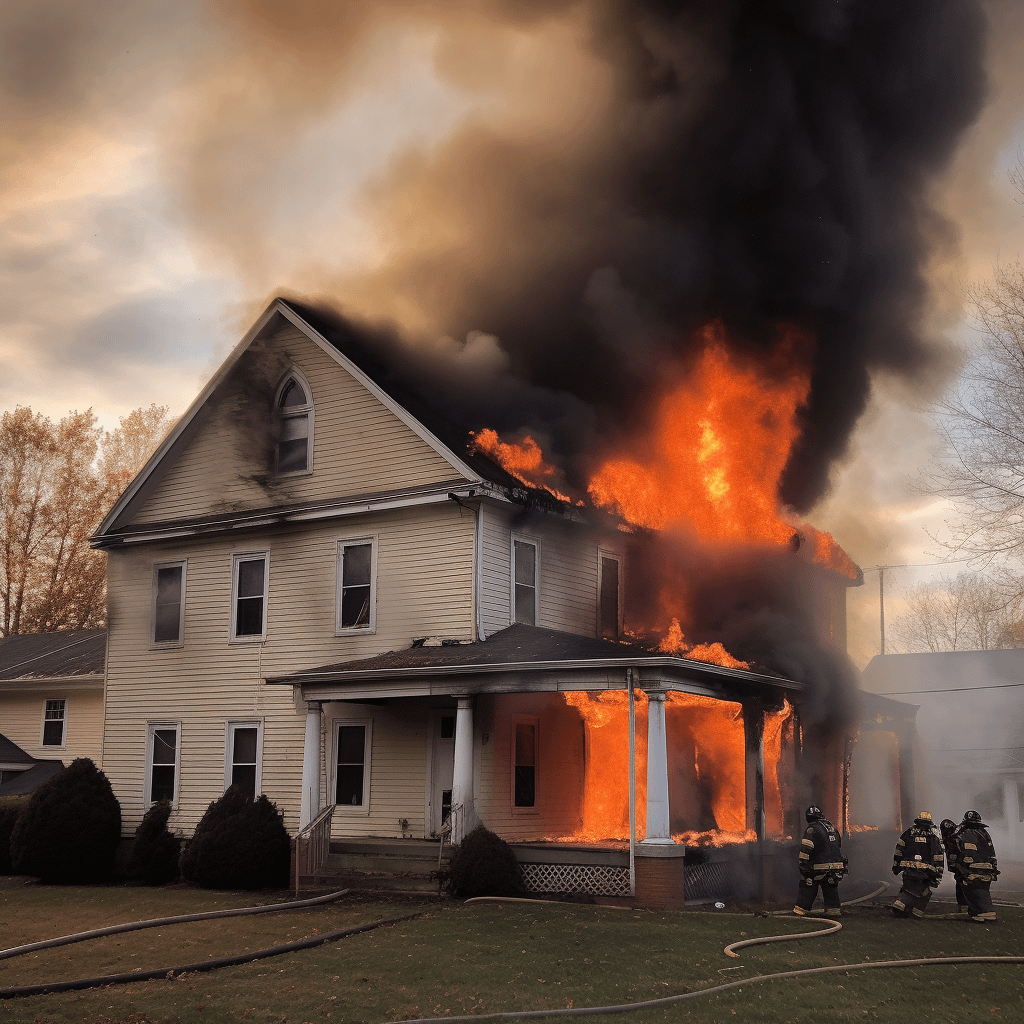

Fire insurance is crucial for protecting your home and belongings from devastating losses. However, having your fire claim denied can be distressing and add frustration to an already difficult situation. Understanding the common reasons why insurance companies deny fire claims can help you navigate the process and protect your rights. If you are facing a denied fire claim, seek professional assistance.

What Does Fire Insurance Cover?

Fire insurance, often included in standard homeowners insurance policies, provides coverage for damage caused by accidental fires. This type of insurance typically includes:

- Structural Damage: Covers damage to walls, roofs, floors, and other integral parts of the building affected by the fire.

- Smoke Damage: Provides compensation for damage caused by smoke, which can harm walls, ceilings, furniture, and belongings.

- Cost of Repairing Damage from Firefighting Efforts: Covers expenses related to water damage and other destruction caused by efforts to extinguish the fire, such as breaking windows or doors.

- Wildfires: Many policies include coverage for damage caused by wildfires, a common concern in certain areas.

- Additional Living Expenses: If you can no longer live in your home due to fire damage, your policy may cover additional living expenses, such as hotel stays and meals, until repairs are completed.

- Personal Liability/Medical Payments: If someone is injured on your property due to a fire, your policy may cover medical payments and liability costs.

However, fire insurance policies may have certain exclusions. For example, they might not cover fires caused by a failure to maintain fire safety measures, such as faulty wiring or neglecting to install smoke detectors. Every policy is different, and you should review yours carefully to understand the fire damage coverage and exclusions that apply to you.

Do Insurance Companies Deny Fire Claims?

Yes, insurance companies can and do deny fire claims for various reasons. One common reason is a determination that the fire was caused by circumstances not covered under the policy, such as arson or neglectful maintenance. If a fire results from faulty wiring that the homeowner failed to repair despite warnings, the insurance company may deny the claim based on a failure to maintain proper safety measures.

Another reason could be insufficient documentation or evidence to support the claim, such as a lack of photographic proof or incomplete records of the damaged property. Sometimes, claim denials may arise from more questionable practices, such as bad-faith insurance tactics. In these cases, the insurance company may unjustly deny a valid claim, delay processing, or offer an unreasonably low settlement.

If you suspect your claim has been denied in bad faith, seeking legal assistance is crucial. An experienced attorney can help uphold your rights and seek compensation for your losses.

How Often Do Insurance Companies Deny Claims?

Insurance companies deny claims for various reasons, often leaving policyholders distressed and confused. In Wisconsin, fire incidents, including those in residential settings, are prevalent. In 2022, the state reported a fire death rate of approximately 11.1 deaths per 1,000 residential fires, which was significantly above the national average of 6.1 residential fire deaths per 1,000 fires. Despite the high occurrence of fires, claim denials are not uncommon due to factors like insufficient evidence, policy exclusions, or misinterpretations by insurers.

While data on the exact denial rates for fire claims in Wisconsin is scarce, it is known that insurance companies can sometimes act in bad faith by denying valid claims or underpaying settlements. Policyholders should know these possibilities and consider legal assistance if they face unjust claim denials.

Legal Practice Areas

Contact us for a free consultation.

Bad Faith Insurance Attorney

Commercial Property Insurance Dispute Lawyer

Property Insurance Dispute Lawyer

Why Do Insurance Companies Deny Claims?

Insurance companies may deny claims for several reasons, often rooted in the specifics of the policy or the circumstances surrounding the incident. Common reasons include:

- Policy Limitations and Insufficient Coverage: Claims may be denied if the policy’s coverage limits are exceeded or if the damage falls outside the scope of the policy. For instance, certain types of fires or damages may not be covered, or the policy may have exclusions that limit coverage.

- Failure to Maintain Fire Safety Measures: If a fire results from the homeowner’s negligence, such as not maintaining smoke detectors or failing to repair faulty wiring, the insurer may deny the claim. Insurance companies often require policyholders to prove they are taking appropriate safety measures as part of the policy agreement.

- Late Submissions and Suspected Arson: Timely reporting of the incident is crucial. Delayed claims can be denied due to the inability to accurately assess damage or determine the cause. Additionally, if arson is suspected, insurers may deny the claim pending investigation, especially if the policyholder is implicated.

- Pre-Existing Damage and Lack of Evidence: If a policyholder submits a claim for damage that occurred before the policy became effective, it will typically be denied. Similarly, insufficient evidence, such as a lack of photographs or inadequate documentation, can lead to denial.

- Misrepresentation or Bad Faith: If a policyholder deliberately provides inaccurate information, the insurance company may deny the claim, and it can also lead to legal consequences. Additionally, insurers can act in bad faith by wrongly denying claims or stalling.

Understanding these reasons can help policyholders navigate the claims process and prepare adequately to avoid denials.

What Is the Difference Between a Rejected Claim and a Denied Claim?

A rejected claim is one that an insurance company has not processed due to incorrect or incomplete information. It typically needs correction or additional documentation before the insurer can review it.

On the other hand, a denied claim has been reviewed but has been refused payment for reasons such as policy exclusions, insufficient coverage, or lack of eligibility. In essence, rejections are usually administrative, while denials are based on the policy’s terms and conditions.

What to Do if Your Fire Insurance Claim Gets Denied

If your fire insurance claim is denied, it is important to take the following steps to protect yourself and pursue the compensation you may be entitled to:

- Carefully Review the Denial Letter and All Policy Documents: Start by thoroughly reading the denial letter to understand the reasons behind the decision. Review your insurance policy documents to verify if the denial aligns with the policy’s terms and conditions.

- Contact Your Insurer for Clarification: Ask your insurance company for specific details about the denial and clarification on any ambiguous points. Maintain a record of all communications, including dates, times, names of the representatives you speak with, and other details.

- Gather Evidence and Documentation: Collect all relevant evidence and documentation, such as photographs of the damage, receipts for repairs, and any others that can support your case. This can include witness statements, police reports, and estimates from contractors.

- Consider Consulting an Insurance Dispute Attorney: If you believe the denial is unjust or in bad faith, consulting an attorney specializing in insurance disputes may be beneficial. An experienced attorney can guide you through appealing the denial or pursuing legal action.

Additional Tips to Maximize Fire Insurance Coverage

Additional ways to maximize your fire insurance coverage include:

- Understand Coverage Limits and Exclusions: Be aware of your policy’s coverage limits and exclusions. Regularly review your coverage and make adjustments to match updates to your home’s value and belongings.

- Ensure Proper Fire Safety Measures: Maintain working smoke detectors and develop a fire escape plan. This enhances safety and supports your claim in the event of a fire.

- Document All Belongings and Communications: Keep an up-to-date inventory of your possessions and maintain records of all communications with your insurance company.

Taking these steps can help you address a denied fire insurance claim and ensure you are adequately covered.

What Does a Fire Insurance Dispute Lawyer Do?

A fire insurance dispute lawyer specializes in assisting policyholders who have been denied fire damage claims by their insurance companies. These legal experts provide essential support in several key areas, helping:

- Review Insurance Policies and Denial Letters: The lawyer will thoroughly review your policy to understand your specific coverage and exclusions. They will also analyze the denial letter to identify the reasons for the denial, ensuring that the insurance company’s decision aligns with the policy terms.

- Gather Evidence: A fire insurance dispute lawyer helps gather critical evidence related to the fire incident. This includes obtaining fire department reports, witness statements, photographs of the damage, and contractor estimates for repairs. This evidence can play a key role in challenging the insurance company’s decision.

- Negotiate with the Insurer: The lawyer will handle negotiations with the insurance company, protecting your rights and advocating for the compensation you deserve.

- Prepare and File a Lawsuit: If negotiations fail, the lawyer can prepare and file a lawsuit against the insurance company.

- Representation in Legal Proceedings: Throughout the legal process, the lawyer will advocate for the policyholder, using their knowledge of insurance law to level the playing field against the insurance company’s legal team.

Justin Wallace, a seasoned professional in insurance law in Wisconsin, has extensive experience handling fire insurance disputes. With deep knowledge of insurance policies and the claims process, he can provide invaluable assistance in securing a fair outcome for policyholders.

Reasons Insurance Companies Deny Fire Claims: FAQ

Below are some of the questions we receive most often from clients and their answers.

Does Homeowner’s Insurance Cover Accidental Fire?

Yes, homeowners insurance generally covers accidental fires, including damage to the structure and personal belongings. This coverage includes damage from flames, smoke, and water used in firefighting. However, exclusions may apply, such as negligence-related incidents.

Does Renters Insurance Cover Fire Damage?

Renters insurance typically covers fire damage to your personal belongings. If a fire damages or destroys your possessions, your renter’s insurance can help with repair or replacement costs, subject to the policy limits and deductibles.

Does Car Insurance Cover Fire Damage?

If you have comprehensive coverage, your car insurance will most likely cover fire damage. Comprehensive insurance generally includes protection against damage from events like fires, theft, and vandalism. If your car is damaged or destroyed by fire, your comprehensive coverage can help cover the repair or replacement costs minus any applicable deductible.

Does Fire Insurance Cover Negligence?

Fire insurance generally does not cover damages resulting from negligence. Coverage typically applies to accidental fires and certain other causes detailed in the policy. Examples of negligence may include improper maintenance or failure to follow safety protocols. It is important to review your policy or speak with your insurer to understand the scope of your coverage and any exclusions.

Does Homeowners Insurance Cover Fire Damage to Neighbor’s Property?

Homeowners insurance typically does not cover fire damage to a neighbor’s property directly. However, it may provide liability coverage if you are legally responsible for the damage. This means your policy could help cover legal costs or settlements if you are held liable for the fire that affects your neighbor’s property.

Tired of Fighting Your Insurance Company? Speak to an Experienced Insurance Dispute Lawyer

If you are frustrated with dealing with your insurance company, consider speaking to an experienced insurance dispute lawyer at Wallace Law. We can help you overcome the complexity of insurance claims and advocate on your behalf.